Why is it better to pay in local currency when traveling abroad?

A few weeks back, I met an old friend who was visiting India from the US. We were finishing lunch and he took out his Amex card to pay. At the end of the payment, I asked him how much did Amex charge him. He mentioned, Amex didn’t charge him anything. Interesting! We wondered why wasn’t he charged any markup fees when we all generally end up paying hefty forex fees while traveling? My friend started asking questions about who charge this fees? Is it the card issuing bank or payment network (Visa / Mastercard)? Somehow the lunch turned into a conversation rabbit hole about foreign currency transactions, which inspired this post.

Is it better to pay in local currency vs base currency?

Would it have been better for my friend (travelling from US) to pay in USD (base currency) vs INR (local currency)? It’s always better to pay in the local currency. In this case, it was better for him to pay in INR. Here is the reason why

When one chooses to pay in the home currency (base currency), the merchant’s payment processor (very simply - it’s the machine against which one swipes the card) applies something called Dynamic Currency Conversion (DCC). Even though it’s better for the merchant / merchant’s payment processor but it’s not beneficial for the user because of the following reasons :

High Exchange Rates: DCC rates often include a steep markup (3-5% higher than standard).

Hidden Fees: Some payment processors apply additional conversion charges.

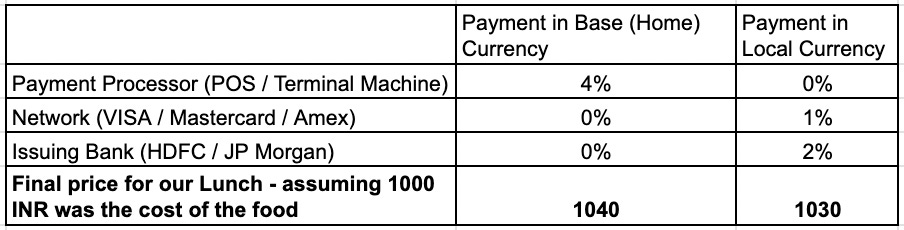

Let’s also understand this via an example. Based on the below table, paying in base (home currency) is costlier than paying in local currency.

Note: I have assumed all the numbers.

How are forex charges applied?

When one pays in local currency, the forex transaction fees can be levied by two parties

The Network (Visa, Mastercard, Amex) - The card network applies a conversion fee (usually ~1%) to convert the local currency into the base currency. This fee is based on the network’s daily exchange rate.

The Issuing Bank - The bank or card issuer often adds an additional forex markup (2-3%) on top of the network's fees. This is where most of the costs come from unless one is using a premium card like the Amex Platinum, which waives these fees (which was the case for my friend)

Which rate is used to calculate the conversion?

The final rate one sees on the statement is determined by the network's exchange rate and issuer’s rate in case of local currency payment. Networks like Visa and Mastercard publish daily exchange rates on their websites. For example, Visa provides its rates through the Visa Currency Conversion Tool

The Amex Card Twist

Now, back to my friend’s Amex card. Why didn’t he face any forex fees?

No Issuer Markup: Some premium cards, like the Amex Platinum or Chase Sapphire Reserve, waive the issuer’s forex markup as a perk for frequent travelers.

Single Network Model: Unlike Visa or Mastercard, Amex acts as both the issuer and the network for its cards. This lets them absorb the network fee too.

Essentially, Amex made my friend’s trip (and finances) easier by removing the typical forex charges.

The Bottom Line

When traveling abroad, try to pay in local currency to avoid costly DCC fees.

Use cards with no foreign transaction fees to save even more.

Check your card’s terms and your network’s exchange rates to understand what you’re paying.

Next time you’re offered the option to base currency (home currency), remember: convenience often comes at a price. Stick with the local currency—and thank me (and my curious friend) later.

Have you had any surprising experiences with forex fees or DCC traps? Share them in the comments—I’d love to hear your stories!